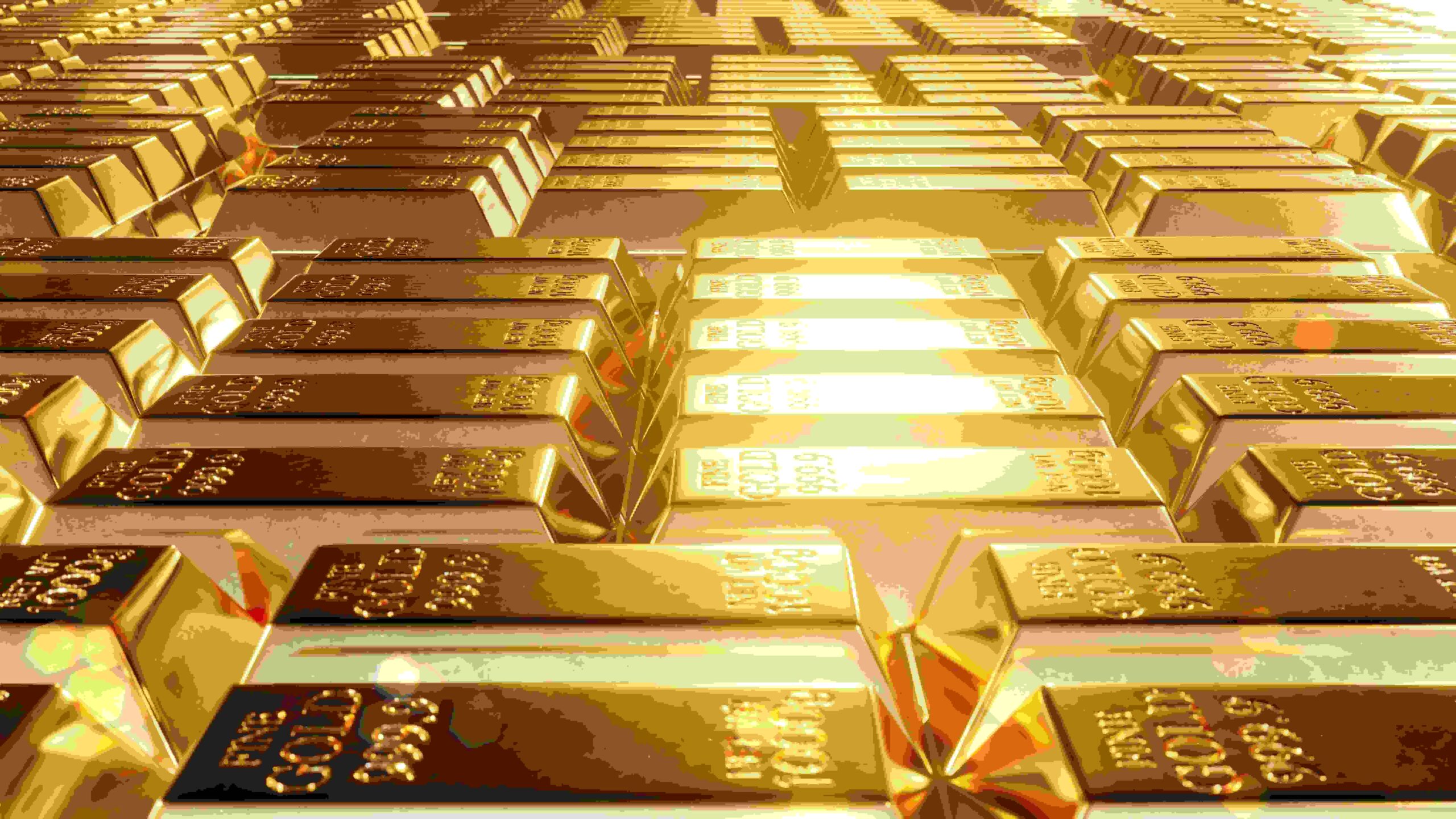

Considered for decades as the ultimate safe haven, gold bar is the best investment in times of economic and political uncertainty. Indestructible is a medium of exchange that maintains its purchasing power over time and cannot be degraded. Find out why you should invest in gold?

Why should you invest in gold?

Investing in gold is considered a guarantee against inflation. Indeed, the value of gold is not based on any debt and cannot be devalued by any government. As a result, even in case of high inflation, one can still trade gold. This makes it a secure investment. The gold bar also makes it possible to build up a precautionary reserve. Physical gold is a wealth at hand whose value increases every year. Thus, at the time of its resale its price is always higher than that of the purchase. In addition, it is considered a universal payment method that can help you in case of problems of bank failure or blocking access to traditional payment methods. This type of investment is not subject to any purchase tax and enjoys an exemption on resale. Accessible to all, gold is a precious gift.

How to invest in gold?

To invest in gold, you have the choice between buying paper gold or buying gold in Paris 7th 75007. If you want to buy physical gold, there are several shops in Paris specializing in the sale of gold bars and coins. However, before acquiring it, you must provide certain supporting documents and have a safe at your home to ensure its security. In addition, investing in paper gold means acquiring shares of gold companies, fund shares and derivatives in gold.

How much to invest in gold?

Except for any capital gains, gold does not generate any income. Therefore, it is recommended to invest only 10% of your wealth and savings. Also, the percentage of investment to be invested also varies from the nature of the savings or insurance product. For a current account it is 20%, for bank books it is 50% and 30% for life insurance, retirement savings plan and PEL. Sponsored